credits: VistaBuzz

You would have heard a lot of news about Jio, you might also be reading about it in the news that someone invested in Jio today And for some percentage, 1000s of crores were invested And if I talk about the recent days, then in total There has been an investment of 1 lakh crores. Just in the past few months So, what happened in Jio because of which so many investors came And want to invest in Jio And who are those investors those who came and invested in Jio.

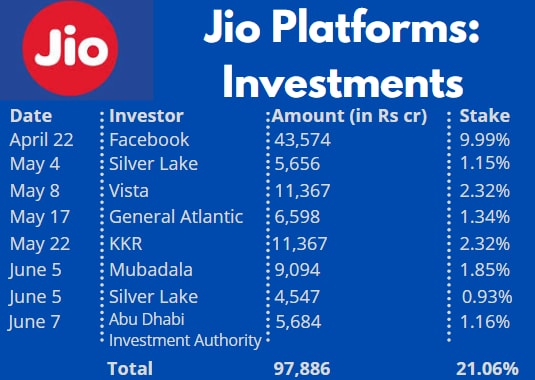

In the recent time apart from this we want to talk about the business model of Jio and how Jio wants to shape itself as an independent company in the coming days, In this, we are going to talk about Jio How much, who has invested in Jio apart from this why does everyone want to invest in Jio And we will talk about some financial parameters which are related to it, Before talking about the business empire of Jio, we will talk about those investment firms that came and invested in Jio And how much did they invest because of which the total investment of Jio which in the recent days has become 97,000 crores and if I talk about how this was started, the first investment was made by Facebook. But, after that daily news started to come about investments in Jio.

credit: cnbc.com

credit: cnbc.com

Firstly, the news came on 22nd April when Facebook, for a 10% stake has invested 43,570 crores in Jio After this if I talk about Silver lake took a 1.15% stake For 5655 crores After that if I talk about Vista, then 2.32% By paying 11,367 crores, after that General Atlantic and then KKR

After that, the recent news that has come out is from Abu Dhabi, There is a company, Abu Dhabi investment authority which is a government company that Paid 5683 crores in Jio And bought a 1.16% stake So from this we get to know that from 22 April to 7 June Jio has diluted almost 21% of its stakes and has got money of around 97,000 crores and this has been quite a good amount for Reliance. The objective that they took of becoming a debt-free company in the coming time, they are moving towards that objective rapidly.

But now let us talk about Jio why does everyone want to invest in Jio If I talk about two months ago People said that there have been a lot of problems in the Telecom sector you shouldn't think of investing here, But what changed now that everyone wants to invest here like if we talk about Bharti Airtel, its share price which once used to trade at 300 Now it has gone to 600 Which means that it gave very good returns The quarterly result it gave was also good, Their ARPU improved by a good amount so people have started feeling that the bad time of the Telecom sector has passed now

Now let's talk about the business model of Jio. Is Jio just a telecom company to just be a Telecom company Or do they have a bigger objective because of which everyone wants to invest here and take a higher stake as well If we talk about the business model of Jio, then it isn't just a telecom company But it wants to be a complete database company, The company that provides you with data services Consider that you want to use a network in your phone. You can use the Jio network for that Jio has penetrated really well there if we talk about devices, which means about telephones there as well, Jio provides its services you can buy Jio phones which they have priced very cheaply So that common people can use that and use mobile data while the mobile data penetration in India can be better After this if I talk about home broadband Even there Jio has penetrated well. So Jio has started its scheme some time back of home broadband that if someone wants to put broadband in their house even there, Jio provides its services After home broadband comes the topic of using different devices in your house from which you take different services like nowadays people are moving towards online platforms in which Jio positioned their products as you know that many people use devices like Apple TV and more To take advantage of the online platform There, Jio got their set-top box using in which you get the benefit of these services, apart from that it is heard that Jio has tried to get their own device like Alexa where voice control can be used throughout the entire house

So the entire objective of Jio is to become a tech-driven company which provides you facilities from home automation to provide network So if I talk about Jio then the partnership they made with Facebook and Whatsapp they got a big benefit from there as they are going to bring those services in the coming days from there. You can make grocery orders directly from Whatsapp As you know that many people are avoiding leaving the house because of the pandemic and they want all their products to reach their homes, They are taking that one step further and Jio is trying to provide you with this facility from where you can directly make a grocery order.

This fulfils the overall objective of Reliance, Now let us talk about some financial parameters related to Jio Which are very important for you as an investor. If I talk about Jio, then Jio has almost 387 million subscribers and here they have shown really good increment in the past some time If I talk about the recent valuation of Reliance Jio comes out to be 5 lakh crores, there if I talk about the revenue of Jio for the overall company Reliance then it's around 24%. So if the overall revenue of Reliance is Rs 100 then the Rs 24 of their revenue comes from Jio and If I talk about ARPU which is a very important parameter in the telecom industry which tells us the Average Revenue per user of the company So if I talk about the ARPU of Reliance Jio, then that Is Rs 130 There if I talk about the ARPU of Airtel then it is the most in the entire industry Which are around Rs 154 And they have recorded this as the highest in the past few months. After this, if we talk about how their ARPU has increased If I talk year by year which means if I compare the same quarter result to last year there has been a small drop in their ARPU but if we talk quarter on quarter, then their ARPU has increased a little bit, the chances of their APRU are still there because the pricing war in this industry that has gone down and a lot of profit can be seen for different telecom companies.

If I talk about the overall market share of Reliance Jio, the market share of Jio is 32% in the overall telecom industry there if I talk about Bharti Airtel, The market share of Bharti Airtel is around 28%. But if we talk about ARPU then in that case, Bharti Airtel performs better there as compared to Jio But the overall objective of Jio is to be listed as an independent company in the coming time. But only time will tell when it will be listed as an independent company but until you feel like you should invest in Jio. But you have to pay attention here that if you invest in Reliance industries your direct investment will not be in Reliance Jio your investment will be diversified that is because the business of Reliance Jio is spread in different sectors. So if their total revenue is Rs 100, as I told you Only 24 rupees of their revenue comes from Jio so if you invest here, you invest in the entire company. You have to know where the overall value of the company is derived from and if you find it good to invest in a particular business unit you have to know the overall revenue that particular business unit gives to the company.

Abhishek Rawat

Content Writer

@DayLightMedia

0 Comments

If you have any doubt please let me know.